Video: Five questions with Maple-Brown Abbott

Article,

3 things to consider in 2023

SHARE

We’re all about partnerships. On a daily basis, our discussions with investors, asset managers and investment consultants spark ideas for collaboration. Here are just three things, highlighted by expert commentators, that we and many of those we work with think should be up for serious consideration this year.

Kevin Duggan, Client Solutions – Tax, Carne Group

Too many institutional investors are still losing out on returns because their funds are paying too much tax – and the performance drag can be substantial. It is complex to ensure correct tax treaty withholding tax rates are applied, but with investment outcomes and good governance being so high on the agenda of investors, tax-efficiency is something that the industry should put even more focus on in 2023.

European investors can benefit from tax-efficient vehicles such as the Irish-domiciled tax transparent Common Contractual Fund (CCF). The primary benefit of the CCF is its withholding tax transparency. This allows custodians/ administrators, to ‘see through’ the fund to the beneficial owners and apply the correct tax rates based on the investors own entitlements. That is particularly important for tax-exempt investors in pooled funds who can end up paying dividend withholding tax that they might otherwise reclaim.

CCFs can encompass different asset classes, including alternative strategies and increasingly popular ESG mandates. This is a particular motivator for institutional investors in the Nordic countries, for example. An existing global equity fund can adopt the CCF structure, allowing firms to offer their preferred strategy in a tax-efficient wrapper.

“They [our pension fund clients] invest across multiple jurisdictions, which makes the post-tax position of their investments particularly important. The CCF offers them valuable tax efficiency and transparency .”1

Essentially, CCFs enable institutional investors to demonstrate that they are always acting in the interests of their beneficiaries by reducing costs, managing tax risks and optimising returns. The tax transparency, and its potentially substantial withholding tax savings, show that they take accountability and governance seriously.

‘Difficult’ shouldn’t mean it isn’t done!

CCFs are complex to set up and not always something an asset manager wants to use valuable resource for. This can be eased by using a third-party provider and the advantages for clients are worthwhile. In addition, aside from enhancing investment performance for existing investors by reducing the tax drag, CCFs can offer managers increased distribution capabilities to sophisticated investors and markets.

The CCF structure, combined with expert administration, servicing and reporting, makes it easier for managers to offer tax-efficient strategies through pooled vehicles in multiple jurisdictions. This gives them access to more investors while helping to reduce administration costs and offering improved returns for those investors.

In November 2022 we hosted a discussion for investment consultants with panellists Catriona Buckley from Gresham House, Stefanie Sahla-Jones from Eversheds Sutherland and Des Fullam from Carne Group. The commentary below is taken from that discussion.

Could 2023 bring a potential ‘watershed moment’ for DC? The Long-Term Asset Fund (LTAF) is a new form of FCA-authorised open-ended investment fund, which is able to invest in a range of long-term illiquid assets – such as social infrastructure, forestry, care-home building, as well as more traditional private markets. By making it easier for DC schemes to invest in private markets, the LTAF could help to unlock a huge amount of capital that can be used to help grow the economy and deliver the social infrastructure projects that the country needs.

LTAFs have greater flexibility in their investment powers compared to other types of authorised fund, for example their exemption from permitted links rules for life funds. This additional flexibility is balanced by placing other stringent requirements on the fund manager and depositary of the LTAF. Given this flexibility, it is clear that there is no ‘one size fits all’ when it comes to this new fund regulation and it will take a huge amount of collaboration and partnership to ensure that the right solutions are developed.

Collaboration is key to drive change

The LTAF offers an exciting opportunity for the UK pension industry. However, it is important to dispel the idea that all liquidity problems go away because “it’s an LTAF”. The LTAF gives us the tools to find the right solution, but we need to work towards building something on a case-by-case basis – and its flexibility means that there we will see a variety of different funds launch under the LTAF framework. It is also imperative that managers, investment consultants, investment platforms, trustees and the regulator all work together to make this a success.

It will require education and perhaps a mind-set shift for some trustees. These things take time and whilst we’re likely to see some innovative master trusts wanting to be seen to be first movers, it’s not anticipated that there will be huge allocations to LTAFs in the early years. However, the UK DC market is predicted to grow to £1 trillion by 2030, and so if private markets can make up even a small portion of that, then the opportunities – for DC investors as well as the UK economy – are potentially huge.

For fund managers, this could be an opportunity to make a positive difference. If it can be made to work, the industry will be contributing to the growth of the UK and helping DC savers to make a meaningful contribution.

Herschel Pant, Senior Consultant Relationship Manager, AXA Investment Managers

COP15, the UN Biodiversity Conference, in December 2022, brought the imperative for collective action on the interconnected risks of climate change and biodiversity loss into sharp focus.

“We cannot reach net-zero without halting and reversing nature-loss, and we cannot tackle biodiversity loss without tackling climate change.”2

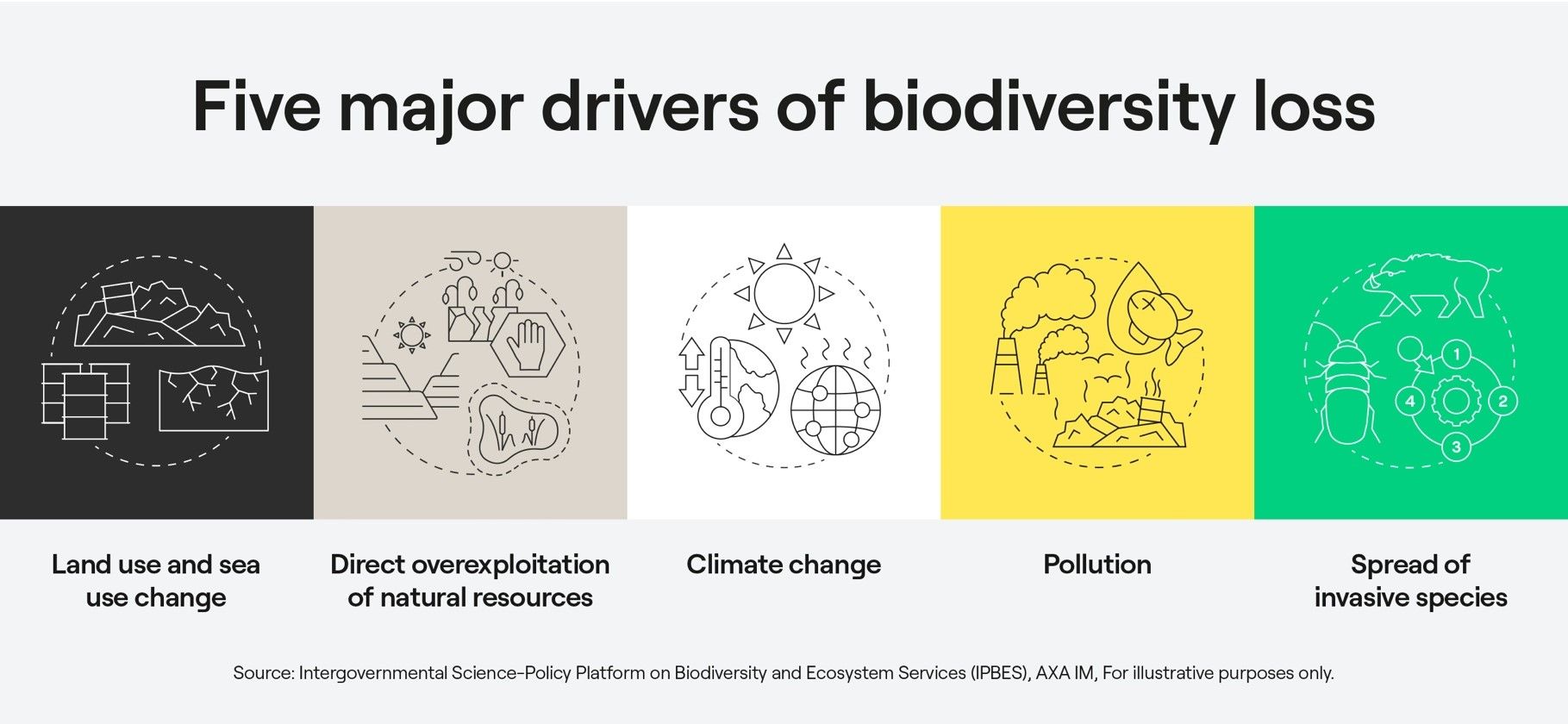

The Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (IPBES) has identified the five major causes of biodiversity loss3. Understanding and mitigating these forces will be vital to prevent lasting damage to the primary resources that humanity relies on.

What gets measured gets managed

Human activity is the biggest cause of biodiversity loss. Creating ways to analyse and articulate how what we do affects biodiversity will help to direct efforts to preserving it.

A key initiative in 2023 will be the formalisation of the Taskforce on Nature-related Financial Disclosures, or TNFD, based on the model established by the Taskforce on Climate-related Financial Disclosures (TCFD). It aims to create a consistent framework for companies to report their exposure to nature-related risks, with the ultimate goal of directing economic activity away from nature-negative outcomes and toward nature-positive outcomes.

Work on the TNFD is ongoing, and metrics are still being developed, but it is likely to move from being voluntary to being a regulatory requirement.

For pension trustees, it is now becoming crucial to understand and mitigate the nature-related risks in their portfolios. Advisors and investment managers can be helpful partners; AXA IM, for example, is developing with Iceberg Data Lab metrics and tools that could do some of the heavy lifting for schemes and help guide investment decisions and engagement.

Invest in change

As well as risk and harm reduction, UK pension funds are in a position to use their power as investors to make a material positive difference to maintaining the natural world. This is where impact investing comes in.

Impact investors seek out projects and ideas with the potential to transform existing products or processes to reduce the impact of human activity on the biosphere. They provide capital to companies that provide social and environmental benefits while also sharing in the profits that can come from innovative ideas.

The pieces are in place to drive change. We think the moment has arrived for investors to understand how they can be part of the solution, to assess how biodiversity risks might affect their investments, and to ensure they are not left behind.

With so many existing challenges, it’s sometimes hard to devote sufficient time to new market developments, even when they could drive increased operational efficiency and offer good outcomes.

If you’re a manager you’re good at generating performance, creating the right sales strategy and planning a sales and distribution scheme. And, along with client communication, that’s your focus.

For pension scheme managers and trustees, your focus is likely to be on ensuring good outcomes through strong governance and being a responsible investor by understanding the impact that your investments can have on things such as climate, environment and society.

Our three highlighted issues are just some of the things that will hit your list of things to think about in the coming year and even considering their impacts will place an additional demand on resources. We’d love to discuss them with you and how we can help with the operational efficiency that might free up your time and resources to bring in the new in 2023.

Wishing you a successful and satisfying journey through the coming year!

Find out how we can help you

Sources:

1 'Five questions with MBA’ | theamx

3 Models of drivers of biodiversity and ecosystem change, IPBES.

Video: Five questions with Maple-Brown Abbott

Article,